Human Resources

Page Navigation

How to Choose a Medical Plan

-

Finding the right coverage may seem complicated. Here are some important things to consider when evaluating your plan options.

- Blue Care Network (BCN) HMO – Three Plans with wellness requirements

- Health Alliance Plan (HAP) HMO – One Plan with no wellness requirements

- Blue Cross / Blue Shield (BCBSM) PPO – One Plan with no wellness requirements

1. Access to Health Care Providers

It is important to understand your plan’s requirements when it comes to doctors, hospitals, and other health care professionals.

- HMO plans cover health care services rendered by a health care provider in the HMO’s network and referrals may be required for visits to specialists, hospital stays, and other services. Costs for non-emergency care received from a non-network provider (or without a referral if/when required) are your responsibility.

- PPO plans allow you to seek care from providers in or outside the PPO network, but you will share more of the costs in the form of higher deductibles, coinsurance, and copays when you use providers outside the network. Referrals are not required, but some services require prior authorization.

- During open enrollment, determine whether your doctors and other providers are in the plan’s network. Unless you are willing to change doctors, this is a good first step in choosing a plan. You can search for providers on the insurance carrier’s website and call your doctor to verify that they are a member of the network.

- See the Key Features chart (on page 4) for more details on the provider networks for each plan.

2. Cost Sharing

DPSCD pays a premium to the insurance company for the coverage you choose. You pay a portion of this premium in the form of employee contributions deducted from your paycheck. Employee contributions vary based on the plans in which you enroll and the number of dependents you enroll for coverage.

When you receive health care services, you pay a portion of the cost for care in the form of out-of-pocket expenses. You are responsible for the following types of out-of-pocket costs in addition to your employee contribution.

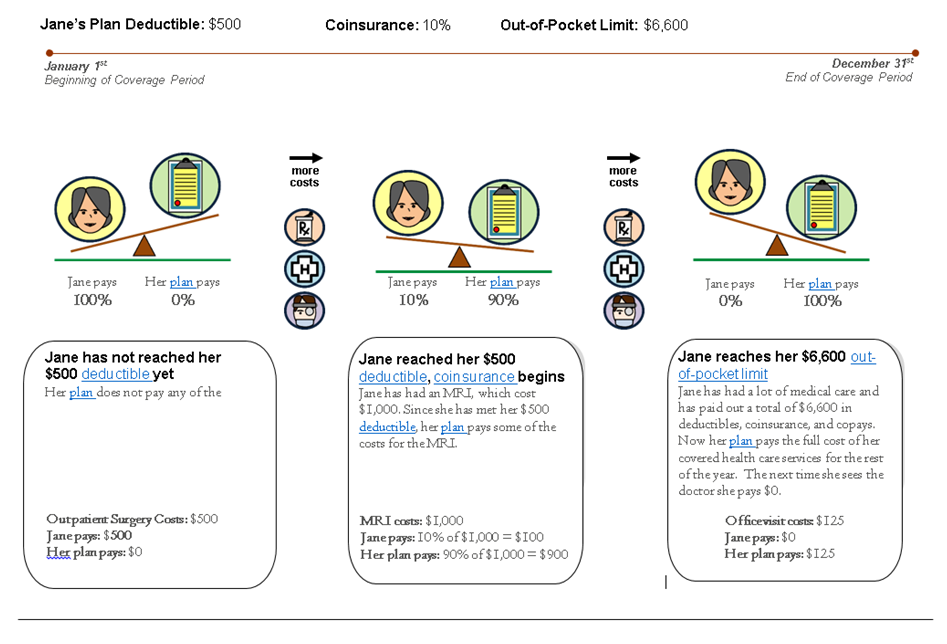

- Deductible: A fixed dollar amount per calendar year that the covered employee or a covered dependent must pay out of-pocket each calendar year before the plan will begin reimbursing for non-preventive health expenses. Plans usually include different deductibles per person and per family. Each covered family member only needs to satisfy his or her individual deductible prior to receiving plan benefits. Benefits are payable for the entire family subject to coinsurance once the family deductible has been reached. (NOTE: The deductible and coinsurance typically apply for services such as hospital stays, surgery, radiology, and diagnostic testing. Some services such as office visits, specialist visits, and prescription drugs only require a flat dollar copay per service.)

- Coinsurance: A percentage of healthcare cost, such as 20%, that the covered employee or a covered dependent pays after meeting the deductible.

- Copay: The fixed dollar amount, such as $20 for each doctor visit, that the covered employee or a covered dependent pays for medical services.

- Out-of-Pocket Maximum (OOPM): The most an employee could pay during a coverage period (per calendar year) for his or her share of the costs for covered services, including deductibles, coinsurance and copays.

- The Cost Sharing Example (on page 3) illustrates how deductible, coinsurance, and out-of-pocket maximums work.

3. Benefit Use

- When you consider your health plan options, it is important to balance your cost to participate in the plan (employee contributions) with the level of out-of-pocket expenses you are likely to pay when you need health care services.

- If you know you will be using your benefits often, you may choose a plan with a higher premium in exchange for lower copays, deductibles, and coinsurance. This means you will pay more in employee contributions from your paycheck throughout the year, but the amount you pay out-of-pocket when using your benefits will be less.

- If much of the care you receive is routine or preventive, you may want to consider a plan that offers a lower employee contribution from your paycheck throughout the year, but your copays, deductibles, and coinsurance may be higher when you need services.

4. Wellness Incentives

- All three of the BCN HMO plans, include steps you must take to earn Enhanced Benefits. Enhanced Benefits are the highest level of benefits under the plans. If you do not take these steps, you will receive Standard Benefits which means that your out-of-pocket costs will be higher when you seek health care services.

- The HAP HMO plan has one level of benefits and does not require you to have an annual physical, complete a health risk assessment or participate in weight-management or smoking cessation programs.

- The BCBSM PPO plan does not require you to have an annual physical, complete a health risk assessment or participate in weight-management or smoking cessation programs. The plan has two levels of benefits depending on whether you use PPO providers or providers outside of the PPO network. You receive the highest level of benefits when you use PPO providers. You may see providers outside of the PPO network, but your out-of-pocket costs may be higher when you seek health care services from a provider outside of the PPO network.

5. Cost Sharing Example

6. Key Features

6. Key FeaturesKey Features

Blue Care Network HMO

Core, Core Plus, and Economy Plan

HAP HMO

Blue Cross Blue Shield Simply Blue PPO

Provider Network Access

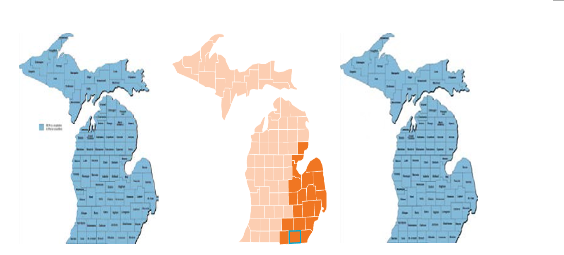

Michigan Statewide network

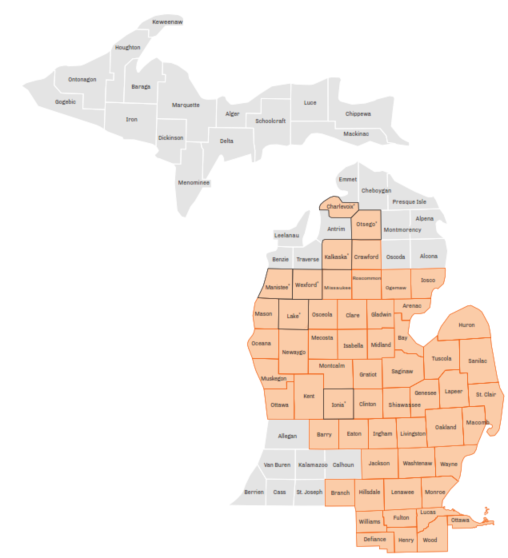

Limited to 50 counties in Michigan

Michigan statewide network plus access to Blue Cross/Blue Shield PPO providers in other states with Blue Card program

Primary Care Physician (PCP) Required?

Yes

Yes

No – but some services require prior authorization

Referral required for specialist visits?

Yes

Not required for most services, but certain specialists may require a referral before they will see you

No

"In-network" benefits?

Yes

Yes

Yes

"Out-of-Network" benefits?

Limited to emergency care

Limited to emergency care

Yes, higher deductible and coinsurance than in-network

Premium Cost

$

$

$$$